Flexible Retirement

From 1st October 2023 the option to draw down part or all of your 1995 Section pension was introduced, this matches the facility already in place to do the same with the 2008 Section & 2015 Scheme

This is the ability to draw down part or all of the pension without the need to retire, this is called Flexible Retirement.

The rules are as follows:

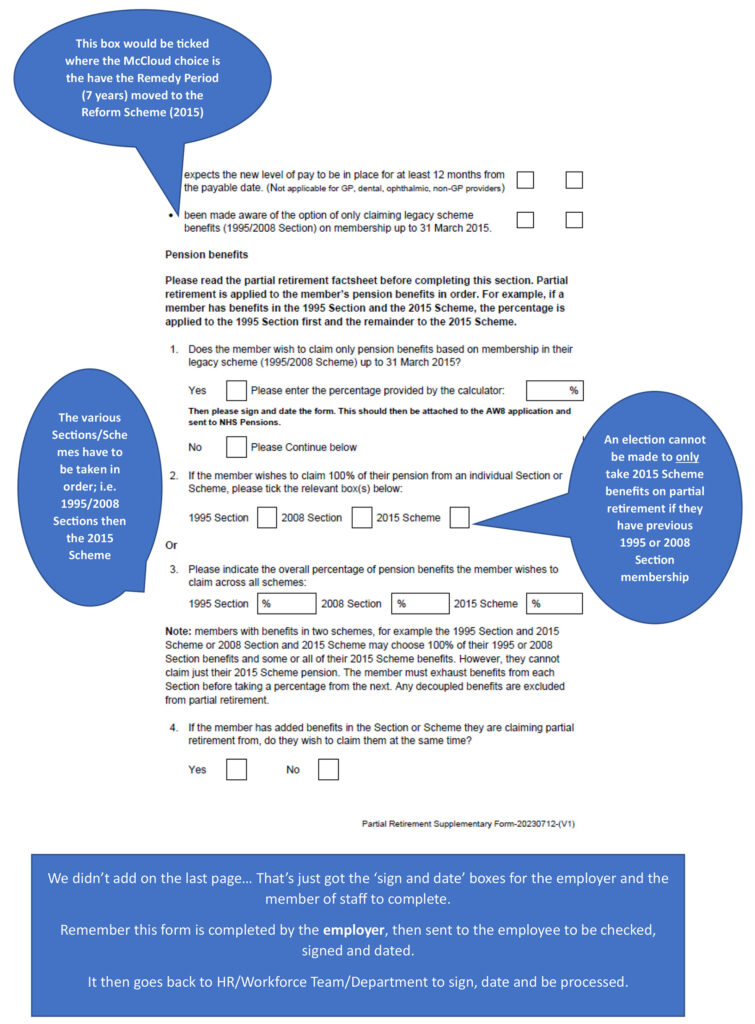

- You have to drawdown your NHS Pensions in the order of those you have; i.e. The 1995, then the 2008, then the 2015

- There has to be a 10% reduction in your Pensionable Pay for AT LEAST 12 Months

- GPs, non-GP providers and dental practitioners need to reduce their NHS commitments by 10%

- You HAVE TO have reached Your Minimum Pension Age for the Section/Scheme you are claiming

- The 1995 Section is 50 (Special Class Status) or 55

- 2008 and 2015 are both 55

- You can Drawdown between 20% and 100% of the Benefits available

- You can continue to build pension in the 2015 Scheme after claiming it, or the other Scheme

McCloud may also impact the pension you receive, this may be a retrospective calculation and could lead to a balancing payment or repayment of pension. Please see the section ‘Your McCloud Choice’ for more information.

Drawing down your pension is an application process and requires that you gain the agreement of your management and it has to go through your HR/Workforce approval process.

There are, as aways forms to fill in:

The AW8 – See next page

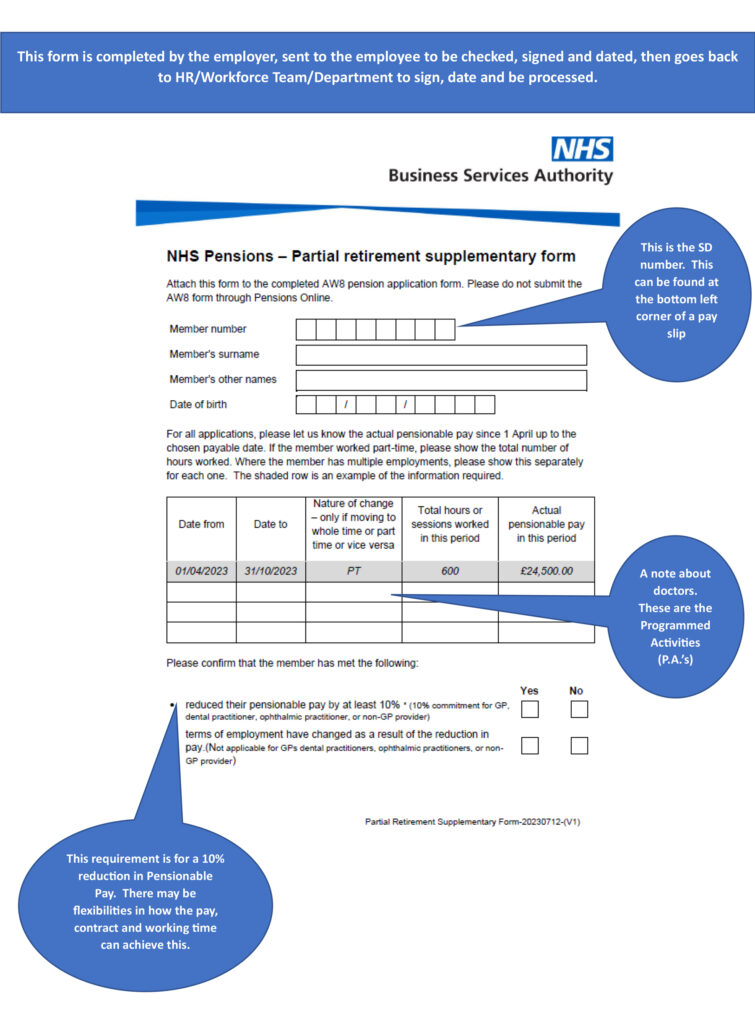

Flexible Retirement Supplementary Form

This form can be obtained from your HR/Payroll/Pension Team as part of your Flexible Retirement process.

Below you’ll find tips on how to fill out the form.